Multi Step Income Statement

Many business owners use different types of financial statements to measure the performance of their company. Among them, the multi step income statement is one of the significant financial statements that’s widely used by most accountants and business owners.

It provides the business owners with an overview of the gross income and expenses of a specific time. A single step income statement is sufficient for smaller companies, but honestly, that’s not perfect for the larger companies.

But what are these things? How they actually work, and what are the differences between both of these income statements? So many questions are swirling in you right now, isn’t it? Let’s clear all of these facts one by one.

What is a Single Step Income Statement?

If you’re a novice and have just started to go through the income statements, you’re probably unknown to all of these factors. Therefore, it’ll be better if we can start from the root, isn’t it?

Even if you know a bit about it, this discussion will provide you with deeper knowledge. So, let’s get started with a single-step income statement first.

A single step income statement presents your business’s profit or loss generated through the equation of income and expenses. The only difference in this method is that it performs all the calculations in one equation only. Let’s have a look at its equation:

Net Income = (Revenues + Gain) – (Expenses + Losses)

A single-step income statement offers the simplest way to find out the financial activity of your business. It’s a straightforward method and quite easy to understand. But its single equation isn’t suitable for larger enterprises. It fails to offer a detailed calculation, which is extremely necessary for large businesses.

What is a Multi Step Income Statement?

A multi-step income statement is a method utilized by accounting professionals to gather insights into a business’s financial performance or investments. Well, it has a lot of similarity with a single-step income statement, but it can solve more complex approaches and deliver detailed analysis by assuming several subtractions to obtain net income.

In simple words, it’s an income statement that gives the net income by subtracting all the expenses from the gross income.

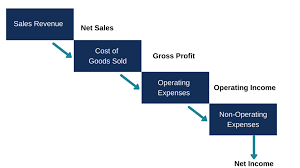

The multi-step income statement differentiates every revenue and expense into two categories; these are operating and non-operating. The multi-step income statement includes gross income, expenses, profits, cost of goods sold, and losses. It provides the final result through the calculation of all these elements.

The final outcome also offers a proper solution for net profits, albeit in the context of what basic market activities are necessary and how much cost the company must incur.

This report allows the business owner and stakeholders to have a detailed look at every aspect of the company. Thus, they can have a look at how the company is progressing and its overall performance. Moreover, they can also ensure the exact location where the resources should be moved and more investment should be made.

Let’s make this more clear with an example. Suppose you’re a restaurant owner, and selling foods is your primary income stream. If you can use a multi-step statement, you’ll be able to figure out where food sales are marketed without showing non-operational data an optimal way. That will be way more beneficial to run the business more efficiently.

Format of a Multi Step Income Statement

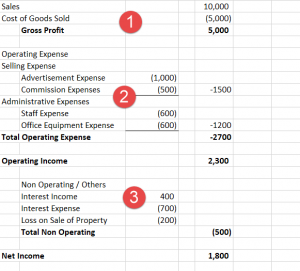

Below you’ll get a format of Multi-Step Income Statement, which will be a bit easier for you to understand. So, let’s have a look at it!

As we’ve mentioned above, there are two primary heads in a multi-step income statement. These two heads have covered the entire incomes and expenditures. However, the direct incomes and trades are mentioned in: –

- Operating Head- Gross Profit

- Operating Head-Selling and Admin Expenses

- Non-Operating Head

1.Operating Head- Gross Profit

Have you noticed the first section of the format where it contains the Gross Profit? At the top of the format, the business’s gross profit is calculated from the subtraction of the cost of goods sold and total sales.

This portion is essential for the creditors and investors as it indicates how much profits the company is making by selling their goods.

As an example, a retailer’s multi-step income statement shall contain a figure for total sales of all goods made for this period, and all expenses incurred while buying, shipping, or transportation and preparing the goods for sale will also be included in the costs of goods sold.

Gross margin is actually the amount that is earned from the sale of the products of a company. No expenditures are included in this calculation. It’s a simple Cash Inflow that originated from the sales of merchandise and a Cash outflow from their purchase. This segment aims to assess the organizational wellness and the productivity of core company activities.

2.Operating Head – Selling and Admin Expenses

If you look at the format again, you’ll notice that the second includes Selling and Admin Expenses. Have you got that? Yes, that one. This section of the multi-step income statement has two different categories Selling and Administrative. All the operating expenses of a company are included in these two categories. Let’s see what types of expenses do these things include.

Selling Expenses – This section includes all the expenses for the sale of the products, namely advertising, salesman’s wage, freight, fees, etc.

Administrative Expenses – This section includes indirect expenditure that is related to the selling of products like office rent, staff’s salary, supplies, etc.

In order to compute the total expenses, both selling and administrative expenses are added together. After that, the total expenses are deducted from the gross income of the first section. And the final calculation is called the company’s operating income.

3.Non-Operating Head

It’s the third section of the multi-step income statement. This section includes the non-operating head as well as other heads of all types of income and expenses, which aren’t related to the main business activities of an organization. A bit complicated, isn’t it? Let’s make it clear.

Suppose a car hit a retailer who is not into the insurance company. But the insurance company paid a certain amount of money for the settlement. In this case, the received money will be considered as a non-operating income instead of the total sales. Therefore, this money will be included in the non-operating as well as other heads.

This heading includes other dividends and expenses such as the settlement of court proceedings, tax, gains and losses on investments as well as other unusual products. There won’t be any subcategories in the non-operating heads because they’ll be under the operating heads already. It only summarizes all these activities and makes a total of them in the end.

Once the non-operating heads are totaled, it’s used for adding or deducting from or to the income for determining the net income.

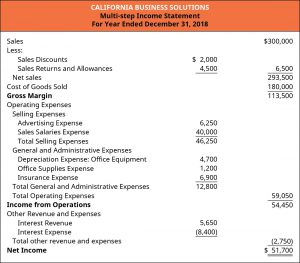

Multi Step Income Statement Example

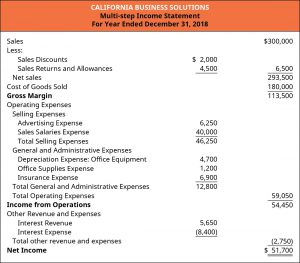

Let’s look at a multi-step income statement example to make things more transparent for you.

If you look at the above template, you’ll notice that there are three steps on which the entire calculation is completed. We’ve already cleared the fact in the above section, but now let’s see how you’re gonna prepare them.

Step 1 – First of all, you have to compute the gross profit using the following formula

Gross Profit= Total sales – Cost of goods sold

In this case, the template has total sales of 300,000 dollars, and the cost of goods sold 180,000 dollars. That’s how the gross profit is 113,500 dollars.

Step 2 – Next, you’ve to compute the Operating Income, and for that, prepare the second section where you’ll subtract total operating expenses from the gross profit. This means:

Operating Income = Gross Profit – Total Operating Expenses

If you look close to the above template, you’ll see that the total operating expenses stand at 59,050 dollars. This amount of money was deducted from the gross profit, and that’s what has made the income from operations 54,450 dollars.

Step 3 – Lastly, you’ve to compute the net income of the company, and this time it’ll include non-operating and other expenses in the calculation.

Net Income = Income from operations + Non-operating and the total of Other Heads

The total operating expenses above calculation are 59,050 dollars, and when it has been deducted from 2, 750 dollars of Income from Operations, the Net Income comes out in 51,700 dollars.

Details

Hopefully, we’ve understood the process. Okay, but let’s take a more in-depth look at what we’ve done and what elements should be categorized under each head.

In the first step, you’ve seen the costs of goods. It’s a separate item from the operating expenses and usually listed in the gross margin section. With the benefit of this section, the Management, investors, and creditors can determine the financial statements and buying efficiency of the company. That’s why this section plays an important role in a multi-step income statement.

The operating section includes a list of the company’s operating income. From this section, the company can have a clear view of how much money they’ve earned by selling its goods and after paying all operating expenses. The company can ensure the health of the business based on the figure obtained through this section.

In this case, the bottom line will always show profitable results if the company’s operations are strong. That’s why it’s considered to be a key section of the multi-state income statement. However, not all businesses with a positive bottom line have good operations. Let’s get back to our example and see what the retailer has got through this section.

It may have lost some revenue because of the operations, but it had an enormous insurance settlement that brought income to the bottom line. So, what do you think? Is this business running in a healthy condition? Probably, it’s not according to the operating section. Isn’t it? See, that’s why this section bears the utmost importance.

The last section includes non-operating and other heads, which are subtracted to compute the net income. Well, that’s the end. The business owner gets a detailed view in the simplest way.

How to Prepare a Multi Step Income Statement

If you know how to prepare an income statement, it’ll be convenient for you to understand. But, as you’re already familiar with the key elements and the operating heads, it’s going to be very easy for you. We’re going to create a multi-step income statement with the following steps:

- Define reporting periods

- Pay proper attention to your document and identify the correct elements for each header section

- Prepare the operating section

- Prepare the non-operating section

- Calculating the net income

1.Define Reporting Periods

Monthly, quarterly, and quarterly, these are commonly used for reporting in periods of the businesses. If you’re trying to prepare an income statement, you’ll first need to identify the time frames that make the most sense about your reporting needs. Businesses can use a reporting schedule that focuses on the timing of board meetings or other reporting activities. Make sure to pick the correct time frame to achieve a reliable and appropriate analysis report.

2. Pay Attention to Your Documents and the Headers

Once you’ve defined the reporting periods, it’s time to concentrate on the headers. So, look at the documents and identify the company along with the name of the statement. You’ve to the right the company name by adding the word “Income Statement” with it. This header should be written right below the top margin, where it’ll also have to include the date and period. The heading should be something like this:

Sample Products and Co. Income Statement

September 2019 – December 2019

3. Prepare the Operating Section

This one is the most important step of a multi-step income statement. As this section includes all operating revenues so, you’ve to start with that first. The operating revenues are originally obtained from sales of goods and services. This figure should be deducted from the company’s accounting system.

After adding the operating revenues, it’s time to add operating expenses. These are usually stored on the accounting software database of an organization. So, you can collect the required information from there. This section includes the costs of goods sold, advertising and every other expense. Once you’ve figured all of them out, you’ve to put these things under the operating expenses category.

Next, you’ve to figure out the gross profit. We’ve already discussed the formulas before so, it’ll be better if you see there.

4. Prepare the Non-Operating Section

The non-operating section includes the revenues and expenses from the non-operating items only. That’s why it doesn’t have many complications. This section also includes interests and transactions over the investments. So, make sure to add them too.

In this case, non-operating income will consider all unforeseen expenses that are not attributable to the expense of doing business. This could include damages on a project that may not do well or compensation taken in favor of court cases or legal bills.

5.Calculation of the Net Income

You’re gonna need to add the operating income and non-operating items. The non-operating items can be negative or positive, based on which the company’s profitability will be determined. You can look at the above example to become more clear about the facts and how to calculate net income from a multi-step income statement.

Anyway, if the end result has a positive figure, then it’s the company’s profit amount. On the contrary, if the figure is negative, then consider the company in a loss.

Benefits of Multi-Step Income Statement

Compared to the traditional income statement, multi-step income statements offer insights into a company’s financial performance. Moreover, it has several other beneficial parts for progressing the business. Let’s have a look at them.

- First and foremost, a multi-step income statement analyzes the core of a business and helps to identify its performance. With the benefit of that, the creditors and investors can ensure the company’s efficiency and working performance.

- An individual can easily identify the functionality and how a company is performing its duties.

- Of course, it offers a detailed look over at every aspect of an organization.

- According to the above multi-step income statement example, the retailer’s key role is to sell his merchandise where creditors and investors want to learn how easily and efficiently the retailer will sell the products without diluting numbers. If you’re a creditor and need to check them all, you need to get through all of these items first. How you’re gonna, do that? Combining all expenditures and incomes won’t provide you with accurate information so, if you’ve planned to do that, it’s not going to work. But if you can list each of them under a particular head, you’ll get a piece of meaningful and understandable information to reach that particular goal. That’s where a multi-step income statement comes in to offer a perfect solution for this purpose.

Single Step vs. Multi Step Income Statement

Hopefully, the above discussion has cleared what multi step income statement actually is? How to prepare a multi-step income statement and how a multi-step income statement example looks like? But do you know what the differences between single-step and multi-step income statement are? After all, these why we would leave this thing.

A single-step income statement calculates the net income of a business through a simple accounting solution. On the other hand, a multi-step income statement calculates the net income with three steps. As a result, the user can have a separate view of the operational from non-operational expenses and revenues. Now, let’s see what the key differences between them are.

- Single-step income statements require few calculations, and that’s why they’re easier to prepare. But a multi-step income statement will break down into operating and non-operating heads, which takes a little effort and time to prepare.

- The single-step income statement focuses on the bottom line, where it shows the net income. This is what makes it a streamlined and straightforward document. But multi-step income statement isn’t that easy to read.

- A multi-step income statement offers greater details through an itemized breakdown of revenues and expenses. A single-step income statement doesn’t show the detail information.

- A multi-step income statement shows the gross profit of the company. But this section is unseen in a multi-step income statement.

- A multi-step income statement shows operating income, which isn’t offered by a single-step income statement.

Wrapping Up

From the above discussion, it’s clear that a multi-step income statement offers more detailed information than the single-step statement. There is nothing as misleading as this if it’s not prepared correctly. For example, Management may shift expenses out of the cost of goods sold and into operations to increase their profits artificially. It is also necessary to look at comparable financial results over time so that you can see the trends and perhaps spot the misleading location of expenditure.

Best Business Ideas Open up your business to new possibilities.

Best Business Ideas Open up your business to new possibilities.